Prof Rodrigue Tremblay writes: "Banking Establishments Are More Dangerous Than Standing Armies." Thomas Jefferson (1743-1826), 3rd US President

"... a serious depression seems improbable; [we expect] recovery of business next spring, with further improvement in the fall." Harvard Economic Society (HES), November 10, 1929

"While the crash only took place six months ago, I am convinced we have now passed through the worst -- and with continued unity of effort we shall rapidly recover. There has been no significant bank or industrial failure. That danger, too, is safely behind us." President Herbert Hoover, May 1, 1930

"Under a paper money system, a determined government can always generate higher spending and hence positive inflation." Fed Chairman Ben Bernanke, in 2002

Many observers think that “prosperity is around the corner” and that this recession, like others since World War II, will end as soon as the stock market, as a leading indicator, recovers and people start spending again. This is a myopic view of the current economic big picture.

In fact, since the peak of the housing bubble (in the U.S.) in 2005, the onslaught of the subprime financial crisis in August 2007 and the beginning of the recession in December 2007, the U. S. economy, and to a certain extent, the world economy, have entered a period of protracted adjustments. For sure, there will be some quarters of positive economic growth ahead and the recession may be declared officially over in the coming months, but the radical economic reorganization that is taking place will go on for years to come.

Why is this so?

Essentially, because we are at the very end of the 60-year inflation-disinflation-deflation Kondratieff cycle that began in 1949 when war-frozen prices were liberalized; and that powerful long cycle is ending now. The post 1980s era, i.e. the Reagan era, is over, but the excesses and bubbles of the last few decades have to be corrected, at a time when large population shifts are about to take place. Such adjustments will take years to unfold and this will entail a lot of efforts and a lot of changes.

Indeed, the era of excessive spending and of excessive debt is over. The era of excessive government economic disengagement and of financial deregulation is over. The era of irresponsible Ponzi-scheme finance is over. The era of unregulated derivatives is over. The era of greed as an ideology is over. The era of wild and predatory capitalism is over. The era of cheap oil, of cheap transportation, of cheap commodities and of cheap food is over. The era of excessive concentration of wealth and income is also over. However, the age of political corruption, of incompetent politicians and of destructive wars of aggression is not over. What has arrived is the age of hyperstagflation.

The central driving force behind most of these developments, besides the collapse of the financial sector, the debt pyramid and the derivative products structure, and irresponsible talk of larger wars by loose cannon politicians (as if there were not enough problems!) is going to be demographic.

Indeed, we have entered a period during which the largest demographic cohort in the history of mankind, the post Word War II baby-boomer generation, has passed its spending peak. This is not something that can be reversed overnight. This is going to be a decade-long process of adjustment, of less spending, of more saving, and above all, of paying off excessive debt loads. Let's keep in mind that consumer spending represents 70 percent of GDP.

The economic consequences are going to be profound and will affect all sectors of the economy. We only have to consider how the automobile industry, once a major engine of economic growth, is presently going through a fundamental reorganization and downsizing. Even computer-based industries have matured and cannot anymore be considered fast growing industries.

The only growth sectors left in the U.S. seem to be the health services industry, as the population is aging, and the war-related industries, as the U.S. military-industrial complex keeps on expanding. But even those sectors will have to slow down; lest they bankrupt the entire economy.

That's why I think these industrial and demographic trends herald a period of slower economic growth that could last many years. Governments better wake up to the challenges that such a slow growth environment entails. Very few people are prepared for such a prolonged period of economic stagnation that will be accompanied by forced debt liquidation, in a deflationary environment.

This is particularly true of private pension plans that will have trouble paying pensions to recipients in the coming years. This is also true for employment that will expand at a slower pace than the working population, at least for a while, resulting in a rise in the level of unemployment.

Baby-boomers are those individuals who were born between 1946 and 1966. Because of its sheer size (more than 70 million people in the U.S.), this generation has been dominant in all spheres of life for the last fifty years. But now, it has passed its spending peak. This occurred in 2005-06, at the very top of the housing bubble.

The average age of the baby-boomer demographic cohort was then 50, which is the age of top spending. At that time, the U.S. personal savings rate fell to a whopping minus 2.5 percent per year. As a comparison, it was 12.5 percent during the 1981-82 recession and it has now rebounded a phenomenal 5.7 percent in April 2009, and it's climbing fast.

Indeed, the end of the housing bubble, the financial crisis, and the economic recession altogether have sent a clear signal to Baby Boomers. You'd better begin saving soon, or your retirement will have to be postponed. And saving means consuming and spending less, while paying up debts, in order to boost net current personal assets to a level that could sustain retirement needs. But if the largest cohort of consumers cuts down on its spending and borrowing, what does it mean for aggregate spending and economic growth?

It can only mean slower overall economic growth and some painful economic adjustments. Therefore, there is a high probability that this recession will be a super one that may linger on for years, being interrupted by short-run upside bursts, but soon being followed by a return of stagnant conditions. In Japan, in the nineteen-nineties, a similar financially and demographically induced recession lingered on for an entire decade. And even after twenty years, it cannot be said that Japan is out of the woods yet.

In the short run, in order to counteract the effects of the financial crisis and to fight the current recession that began officially in December 2007 (according to the National Bureau of Economic Research- NBER), the Obama administration has devised a three-quarter billion dollar stimulus plan and has let the fiscal deficit explode to more than two trillion dollars a year because of its bail-out of the troubled banks.

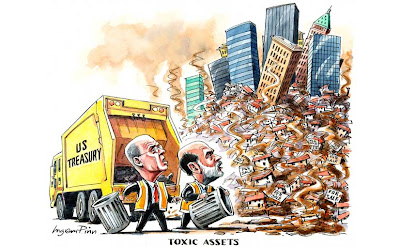

Similarly, the Fed has lowered short-term rates to zero and has purchased billions of dollars in long-term Treasury securities, in government agency securities, and even in mortgage-backed securities, in a desperate effort to save large financial institutions such as AIG, Fannie and Freddie, and other American financial institutions from imploding.

But now bond investors, especially international investors, are selling Treasury bonds and are pushing long-term interest rates up and the U.S. dollar down as inflation fears increase, even though paradoxically the collapse of the pyramid of debts creates a deflationary environment for the entire economy.

The danger here is that bond investors will be selling Treasury bonds faster than the Fed can buy them. In which case, there will be a downward spiral in bond prices as inflation and solvency fears are exacerbated. In a word, if the Fed does not tone down its current policy of excessive monetizing of public and private debts and its obvious 'benign neglect' policy toward the dollar, high inflation and possibly even hyperinflation become a possibility down the road. This has happened elsewhere in the past and there is no reason why it could not happen again, especially if the U.S. keeps getting involved in costly wars abroad, paying those adventures with money it does not have.

For now, a quick resurgence of inflation is only a remote possibility. This is nevertheless a possibility, considering that central banks have a tendency to overdo the printing of fiat money. In fact, if governements attempt to print their way out of the coming structural demographic problem, they will end up generating an hyperstagflation.

In a nutshell, this is what the huge international dollar-denominated bond market sees and fears, at a time when it has to absorb a huge supply of new bond issues. In reality, the bond market will always win against any central bank, any time. The solvency woes and the likely default of the state of California on its outstanding debt will only add to the anxiety.

A few weeks ago, I warned against the risk of future long term interest rates hikes and future U.S. dollar depreciation following the decisions by the U.S. Treasury and by the Fed to flood the markets with trillions of dollars of new Treasury bond issues and with newly printed money. The undertow is coming even faster than I thought.

Only when the markets expect relative economic stagnation and a lasting deflationary environment will long term interest rates taper off.

Brace yourself and hold on to your britches. There is a rough economic decade ahead.

Airlines globally have struggled in the past year as the economic crisis sapped demand for travel and trade, and as passengers turn to discount carriers to cut costs.

Airlines globally have struggled in the past year as the economic crisis sapped demand for travel and trade, and as passengers turn to discount carriers to cut costs.