Sunday, September 20, 2009

Wednesday, September 16, 2009

Gold Futures Advance on Inflation-Hedge Demand; Silver Gains

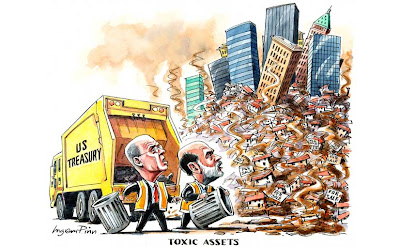

Federal Reserve Chairman Ben S. Bernanke said the worst U.S. recession since the 1930s has probably ended, while warning that growth may not be strong enough to reduce unemployment quickly. The Fed has kept its benchmark lending rate as low as zero since December. It authorized $1.45 trillion in purchases of mortgage-backed securities and other housing debt this year.

Federal Reserve Chairman Ben S. Bernanke said the worst U.S. recession since the 1930s has probably ended, while warning that growth may not be strong enough to reduce unemployment quickly. The Fed has kept its benchmark lending rate as low as zero since December. It authorized $1.45 trillion in purchases of mortgage-backed securities and other housing debt this year.“The market believes that the Fed is not going to be able to withdraw the funds fast enough and that would cause inflation,” said Leonard Kaplan, the president of Prospector Asset Management in Evanston, Illinois. “I don’t believe that for a minute, but this is what the market believes.”

Gold futures for December delivery gained $5.20, or 0.5 percent, to $1,006.30 an ounce on the Comex division of the New York Mercantile Exchange. On Sept. 11, the metal reached a record closing price of $1,006.40.

The price for immediate delivery gained $6.63, or 0.7 percent, to $1,006.93 at 2:54 p.m. New York time. Eighteen of 19 raw materials in the Reuters/Jefferies CRB Index rose today, led by a record surge in corn.

“The debate on gold’s price prospects remains alive and well among both fundamentals-followers and technicians poring over charts,” Jon Nadler, a Kitco Inc. senior analyst in Montreal, said in a note.

The dollar fell against a basket of six major currencies, extending a slide to the lowest in 11 months. Gold futures have rallied 28 percent since the demise of Lehman Brothers Holdings Inc. a year ago as investors bought precious metals to protect their wealth amid the first global recession since World War II.

Possible ‘Reversal’

“Charts indicate that if the $1,050 level is not attained during the current ‘break-out’ or if a double or triple top is confirmed under that same level, then gold could signal a reversal such as the ones that occur on average about every six years,” Nadler said.

Futures reached an 18-month high of $1,013.70 on Sept. 11. Gold may climb to as high as $1,100 in the next six months, researcher GFMS Ltd. said yesterday.

Sales at U.S. retailers in August surged 2.7 percent, the most in three years, from July, government data showed today.

“Gold is continuing to knock on the $1,000 door without making a concerted effort either way to test resistance or support,” GoldCore Ltd., a brokerage in Dublin, said in a note. “Gold needs to push above $1,012 in the short term and $1,020 in the longer term for the upward momentum to be regained.”

Net Longs

Hedge-fund managers and other large speculators increased their bets on rising New York gold futures to a record in the week ended Sept. 8, the U.S. Commodity Futures Trading Commission said last week. Net-long positions jumped 22 percent to a 224,676 contracts, the biggest increase this year.

Silver futures for December delivery in New York rose 37.7 cents, or 2.3 percent, to $17 an ounce. The price has gained 51 percent this year.

Platinum futures for October delivery was little changed at $1,320.30 an ounce on the Nymex. Palladium futures for December delivery gained 0.2 percent to $296.25 an ounce.

Tuesday, September 1, 2009

Stocks Bull Market Signals September Opportunity for the Bears

Dear Reader

The Stocks bull market continued to forge ahead with the Dow closing at 9544, after hitting a high of 9630 during the week, which is a stones throw from the target of 9,750, having advanced 3,280 points and more than 50% in less than 6 months, now it will be interesting to see how the market behaves as it enters the target zone for the termination of this phase of the bull run of between 9750 to 10,000, as my analysis of 5 weeks ago (updated this week) called for a more significant correction to follow than that which transpired during June to July, perhaps just about the time when many of the public bears throw in the towel and the not so smart money starts to pile in as greed replaces fear?

The perma bears having missed the whole bull market as each minor dip was THE end of the mistakenly labeled "bear market rally" for the rules are clear, pick up any reputable technical analysis book and you will read that a bull market is confirmed when an stock indices rallies by 20%, similarly a bear market is confirmed when an indices falls by 20% from a high, therefore regardless of the perma views of this being a bear market rally, whilst under the basis of technical analysis this rally has long since been confirmed as a bull market more than 30% ago! So much for the claims of following the basic tenants of Dow theory!

The perma bears having missed the whole bull market as each minor dip was THE end of the mistakenly labeled "bear market rally" for the rules are clear, pick up any reputable technical analysis book and you will read that a bull market is confirmed when an stock indices rallies by 20%, similarly a bear market is confirmed when an indices falls by 20% from a high, therefore regardless of the perma views of this being a bear market rally, whilst under the basis of technical analysis this rally has long since been confirmed as a bull market more than 30% ago! So much for the claims of following the basic tenants of Dow theory!

The stock market's powerful advance of 50%+ may soon give an opportunity for the perma bears to crow loudly as the market heads into the seasonally weakest period of the year i.e. Sept to October, especially as an technically overbought rally is well primed to achieve the anticipated 'significant' correction, perhaps even a crashette, where readers need to remember that the bull market would still remain intact as long as the Dow does not fall by more than 20% from the peak.

Rules exist for a reason, and that is to arrive at a FIRM TRADEABLE CONCLUSION, rather the deluded fixation that is indicative of a perma attitude that are perpetually fixated to one side regardless of the actual price action i.e. the whole rally has been supported by the crash is coming mantra for the past 6 months! A totally useless repetitive statement when it comes to the monetizing of analysis. There is no point in catching a say 15% drop if one fought against the 50% rally, as the net position is still for a 35% LOSS!

The target for the rally from 6470 has been for a move to 9750 to 10,000, at this point in time I continue to favour a price slightly north of 10,000 which would be enough to sucker early bears into losing positions, and as I voiced in this weeks update, the market's strong advance now points to an earlier peak.

Meanwhile the US Dollar continued to play out a double bottom pattern which is potentially bearish for gold, which in itself has traded in a tightening range that is likely to resolve soon, which again perma gold bugs hope will be to the upside though as my dollar analysis suggests it is more probably likely to be to the down side. I will cover Gold's probable trend in an in depth analysis next week as the existing analysis / forecast of January 2009 has expired.

On the topic of stock market plunges, Robert Prechter's latest 10 page Elliott Wave Theorist Newsletter, within which he states that the financial crisis is NOT over and gives a warning he's never had to include in 30 years of analysis.

Its Free, so grab it while you can !

Your stock index trading analyst.

By Nadeem Walayat

-

Scan 26 Apr 2024 - Symbol TypeDateClose PriceVolume13 Day RSI ATAIMS Overbought 4/26/2024 0.32 46277700 72.25 AWC Overbought 4/26/2024 0.935 1610700 75.71 AXREIT Overbought 4/...18 hours ago

-

Scan 26 Apr 2024 - Symbol TypeDateClose PriceVolume13 Day ADX13 Day +DI13 Day -DI D&O Long 4/26/2024 3.18 875400 22.05 26 25 FRONTKN Long 4/26/2024 3.89 3155100 20.79 23 22 MA...18 hours ago

-

-

历史、经济、勇气! - “未经他人苦,莫劝他人善。” 在翻看华夏那些黑暗时代的日子时,心里都不好受,那时代许多有识之士,人材都被不理想的环境埋汰了。很多都因政治斗争被犧牲了,可悲的是许多次无数人的性命消失都只为了个人利益或个人政治议程。它的代价是人民群众仿是永远看不到好日子来臨,而对外总是被人欺负,可恥的是有些人假借几个领袖曾说的“词...2 days ago

-

The lesser I know the irrelevant ......CONVINCING MARKET - Reflection of the whole philosophy behind each and every actions in the market has made me to realize that for too long many people think that the magic ...1 week ago

-

ONLINE STORE - salvadordali - Do visit the online store for products created by salvadordali the blogger. Here are a few of the items available. https://salvadordali.clickasnap.s...1 month ago

-

-

KLCI hovers below 1500: Very Bearish - From May to Aug 2022, KLCI tops 1600 in mid May, plunges to 1420 in mid July and since has recovered to 1500. World economy is in shambles, liquidity cr...1 year ago

-

Lazada 5.5 Bank Vouchers - Lazada Bank/Partner Vouchers & Offers Link: https://mypromo.my/lazada/bank/vouchers *Links to specific bank to collect their vouchers. * CIMB > htt...1 year ago

-

GCB: Earnings Improved On Increased Sales Volume & Higher Profit Margins - *Results Update* For QE31/12/2021, GCB's net profit rose 49% q-o-q or 8% y-o-y to RM51 million while revenue rose 9% q-o-q or 6% y-o-y to RM1.088 billion....2 years ago

-

PTPTN Payment Suspension - For those are affected on income by this MCO 3.0 Now you can apply suspension of payment PTPTN for three (3) months Application is started from 10th ...2 years ago

-

weekly e-meeting 9.30pm - *9.30pm to 11pm * All are welcomed to my weekly e-meeting today and next Monday (every Monday 9.30pm for whole year) *note* : would be uploaded the c...3 years ago

-

Hammer 2019-08-05 - Symbol TypeDateCloseHighLow AXIATA GROUP BERHAD [S] (6888) Black Hammer 8/5/2019 4.94 5 4.77 BIMB HOLDINGS BERHAD [S] (5258) Black Hammer 8/5/2019 4.18 4.2 ...4 years ago

-

"Hibiscus - the story of a succesful SPAC"? - *Article* in The Star, one snippet: *"Hibiscus should not only be applauded for being the first SPAC, but also a successful one."* I have been rather sc...6 years ago

-

Year 2017 - 55.53% Return From KLSE !!! - 1. Wishing you a very Happy New Year of 2018 ^^ 2. As we come to an end of year 2017. Time for me to report my result for the full year of 2017 KLSE pe...6 years ago

-

Life : Human Smartest in this Planet, really? - *"Human Species" issue : Death is part of life vs Immortality.* From my opinion, there is still a hope out there. It's the human duty to discover and unc...6 years ago

-

Stock Selection Points To Note - Core business The first thing I look at when evaluating a stock to buy is the company’s business model. What it does and how it generates profit is importan...7 years ago

-

-

I am alive but still in hibernation - At first I thought I will only start to update my blog when the bear market is here. The logic was to save myself from the anguish of being screw by people...7 years ago

-

The KLCI Near The Critical Zone (Major Support) 1,659 Points. - Based on the chart reading, the KLCI is heading to another low as at 14.09.2016. Right now we can see the index just sit on top of the 200 days moving a...7 years ago

-

Najib Razak 1MDB Scandal: Malaysian Prime Minister's Accounts Triggered Internal Money-Laundering Alarm - So much money was pouring so rapidly into the Malaysian Prime Minister's personal bank accounts that it rang internal money-laundering alarms inside AmBan...8 years ago

-

-

Credit Card Numbers Validation and Generator - Credit Card Number and Debit Card Numbers format follow the standard format of ISO/IEC 7812 and it consists of up to 19 digits. The structure is as follo...8 years ago

-