Sunday, September 20, 2009

Wednesday, September 16, 2009

Gold Futures Advance on Inflation-Hedge Demand; Silver Gains

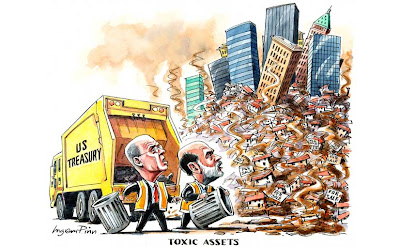

Federal Reserve Chairman Ben S. Bernanke said the worst U.S. recession since the 1930s has probably ended, while warning that growth may not be strong enough to reduce unemployment quickly. The Fed has kept its benchmark lending rate as low as zero since December. It authorized $1.45 trillion in purchases of mortgage-backed securities and other housing debt this year.

Federal Reserve Chairman Ben S. Bernanke said the worst U.S. recession since the 1930s has probably ended, while warning that growth may not be strong enough to reduce unemployment quickly. The Fed has kept its benchmark lending rate as low as zero since December. It authorized $1.45 trillion in purchases of mortgage-backed securities and other housing debt this year.“The market believes that the Fed is not going to be able to withdraw the funds fast enough and that would cause inflation,” said Leonard Kaplan, the president of Prospector Asset Management in Evanston, Illinois. “I don’t believe that for a minute, but this is what the market believes.”

Gold futures for December delivery gained $5.20, or 0.5 percent, to $1,006.30 an ounce on the Comex division of the New York Mercantile Exchange. On Sept. 11, the metal reached a record closing price of $1,006.40.

The price for immediate delivery gained $6.63, or 0.7 percent, to $1,006.93 at 2:54 p.m. New York time. Eighteen of 19 raw materials in the Reuters/Jefferies CRB Index rose today, led by a record surge in corn.

“The debate on gold’s price prospects remains alive and well among both fundamentals-followers and technicians poring over charts,” Jon Nadler, a Kitco Inc. senior analyst in Montreal, said in a note.

The dollar fell against a basket of six major currencies, extending a slide to the lowest in 11 months. Gold futures have rallied 28 percent since the demise of Lehman Brothers Holdings Inc. a year ago as investors bought precious metals to protect their wealth amid the first global recession since World War II.

Possible ‘Reversal’

“Charts indicate that if the $1,050 level is not attained during the current ‘break-out’ or if a double or triple top is confirmed under that same level, then gold could signal a reversal such as the ones that occur on average about every six years,” Nadler said.

Futures reached an 18-month high of $1,013.70 on Sept. 11. Gold may climb to as high as $1,100 in the next six months, researcher GFMS Ltd. said yesterday.

Sales at U.S. retailers in August surged 2.7 percent, the most in three years, from July, government data showed today.

“Gold is continuing to knock on the $1,000 door without making a concerted effort either way to test resistance or support,” GoldCore Ltd., a brokerage in Dublin, said in a note. “Gold needs to push above $1,012 in the short term and $1,020 in the longer term for the upward momentum to be regained.”

Net Longs

Hedge-fund managers and other large speculators increased their bets on rising New York gold futures to a record in the week ended Sept. 8, the U.S. Commodity Futures Trading Commission said last week. Net-long positions jumped 22 percent to a 224,676 contracts, the biggest increase this year.

Silver futures for December delivery in New York rose 37.7 cents, or 2.3 percent, to $17 an ounce. The price has gained 51 percent this year.

Platinum futures for October delivery was little changed at $1,320.30 an ounce on the Nymex. Palladium futures for December delivery gained 0.2 percent to $296.25 an ounce.

Tuesday, September 1, 2009

Stocks Bull Market Signals September Opportunity for the Bears

Dear Reader

The Stocks bull market continued to forge ahead with the Dow closing at 9544, after hitting a high of 9630 during the week, which is a stones throw from the target of 9,750, having advanced 3,280 points and more than 50% in less than 6 months, now it will be interesting to see how the market behaves as it enters the target zone for the termination of this phase of the bull run of between 9750 to 10,000, as my analysis of 5 weeks ago (updated this week) called for a more significant correction to follow than that which transpired during June to July, perhaps just about the time when many of the public bears throw in the towel and the not so smart money starts to pile in as greed replaces fear?

The perma bears having missed the whole bull market as each minor dip was THE end of the mistakenly labeled "bear market rally" for the rules are clear, pick up any reputable technical analysis book and you will read that a bull market is confirmed when an stock indices rallies by 20%, similarly a bear market is confirmed when an indices falls by 20% from a high, therefore regardless of the perma views of this being a bear market rally, whilst under the basis of technical analysis this rally has long since been confirmed as a bull market more than 30% ago! So much for the claims of following the basic tenants of Dow theory!

The perma bears having missed the whole bull market as each minor dip was THE end of the mistakenly labeled "bear market rally" for the rules are clear, pick up any reputable technical analysis book and you will read that a bull market is confirmed when an stock indices rallies by 20%, similarly a bear market is confirmed when an indices falls by 20% from a high, therefore regardless of the perma views of this being a bear market rally, whilst under the basis of technical analysis this rally has long since been confirmed as a bull market more than 30% ago! So much for the claims of following the basic tenants of Dow theory!

The stock market's powerful advance of 50%+ may soon give an opportunity for the perma bears to crow loudly as the market heads into the seasonally weakest period of the year i.e. Sept to October, especially as an technically overbought rally is well primed to achieve the anticipated 'significant' correction, perhaps even a crashette, where readers need to remember that the bull market would still remain intact as long as the Dow does not fall by more than 20% from the peak.

Rules exist for a reason, and that is to arrive at a FIRM TRADEABLE CONCLUSION, rather the deluded fixation that is indicative of a perma attitude that are perpetually fixated to one side regardless of the actual price action i.e. the whole rally has been supported by the crash is coming mantra for the past 6 months! A totally useless repetitive statement when it comes to the monetizing of analysis. There is no point in catching a say 15% drop if one fought against the 50% rally, as the net position is still for a 35% LOSS!

The target for the rally from 6470 has been for a move to 9750 to 10,000, at this point in time I continue to favour a price slightly north of 10,000 which would be enough to sucker early bears into losing positions, and as I voiced in this weeks update, the market's strong advance now points to an earlier peak.

Meanwhile the US Dollar continued to play out a double bottom pattern which is potentially bearish for gold, which in itself has traded in a tightening range that is likely to resolve soon, which again perma gold bugs hope will be to the upside though as my dollar analysis suggests it is more probably likely to be to the down side. I will cover Gold's probable trend in an in depth analysis next week as the existing analysis / forecast of January 2009 has expired.

On the topic of stock market plunges, Robert Prechter's latest 10 page Elliott Wave Theorist Newsletter, within which he states that the financial crisis is NOT over and gives a warning he's never had to include in 30 years of analysis.

Its Free, so grab it while you can !

Your stock index trading analyst.

By Nadeem Walayat

-

失速的资本、制造无限AI - 资本为了增长点,已经投入了近万亿美元去开发人工智能,它已成为没有回头路的投资风险。 目前最讽刺的是:*正是人类社会的竞争机制(资本回报率、地缘政治博弈),成了AI失控的催化剂。* - *没有刹车片:* 在资本的逐利驱动下,谁先研发出更强的AI,谁就能掌握分配权。这种“军备竞赛”导致没...16 hours ago

-

Scan 23 Jan 2026 - Symbol Type Date Close Price Volume 13 Day RSI AFFIN Overbought 2026-01-23 2.66 5888100 75.11 AWANTEC Overbought 2026-01-23 0.36 1504100 73.37 BONIA Overbou...2 days ago

-

Scan 23 Jan 2026 - Symbol Type Date Close Price Volume 13 Day ADX 13 Day +DI 13 Day -DI IGBCR Long 2026-01-23 0.64 111300 23.49 21 18 TM Long 2026-01-23 7.96 4397500 27.66 25 ...2 days ago

-

Stock Market Crashes: Behavioral vs Fundamental Analysis - Key Takeaways on Market Crashes Core Insight: Stock market crashes are not caused by a specific news event or by prices simply being “too high.” Instea...1 week ago

-

FORECASTING price targets into the future - My opinion - IT is possible to forecast price target levels into the future BUT one need to put safety measures in place. I would classify price forecasting into 2, n...3 weeks ago

-

Grumpy Old Man Syndrome - Sometimes we stereotypify something because we can see them in substantive numbers but we may not understand why they occur. Grumpy old men ... we all hav...2 years ago

-

GCB: Earnings Improved On Increased Sales Volume & Higher Profit Margins - *Results Update* For QE31/12/2021, GCB's net profit rose 49% q-o-q or 8% y-o-y to RM51 million while revenue rose 9% q-o-q or 6% y-o-y to RM1.088 billion....3 years ago

-

weekly e-meeting 9.30pm - *9.30pm to 11pm * All are welcomed to my weekly e-meeting today and next Monday (every Monday 9.30pm for whole year) *note* : would be uploaded the c...5 years ago

-

Wahed Invest Roboadvisor Invite Referral Code: liehue1 - Want to sign up and start investing with Wahed Invest? Get *RM20** (*previously RM40*) for free if you sign up today with our referral code:liehue1 *Follow...5 years ago

-

-

Good Bye Maybank 2 Gold Cards~ - I used to use Maybank 2 Gold Cards for last few years. But after revise cashback policy. It is not as attractive as before. I do believe Public Bank Qua...6 years ago

-

Hammer 2019-07-31 - Symbol Type Date Close High Low DAGANG NEXCHANGE BERHAD [S] (4456) Black Hammer 7/31/2019 0.275 0.28 0.265 DAIBOCHI BERHAD- WARRANTS 2017_2022 [S] (8125WB) ...6 years ago

-

ASB Unitholders Get Up to 7.00 sen Dividend & Bonus for 2018 - Amanah Saham Bumiputera (ASB) unitholders will receive a dividend of 6.50 sen and a bonus 0.50 sen per unit for the financial year ending 31st December 2...7 years ago

-

Dual class shares: another really bad idea (4) - Article at Bloomberg's website: *Singapore Exchange Takes on Hong Kong With Dual-Class Shares* One snippet: *Singapore Exchange Ltd. said it allow compan...8 years ago

-

Tools for Checking Stock or Shares - Being shares investor, we could not simply put our money without looking at their company financial status. Whether Hold, Buy or Sell, every decision is...8 years ago

-

KLCI hovers at 1760: Bearish - Over the past months we have seen the KLCI approaching the target of 1800 but never quite breach that mark and since then it has tumbled to the current ra...8 years ago

-

-

IQ Group has the metrics to outperform - https://online.capitalcube.com/#!/stock/my/malaysia/51078 years ago

-

Merry Christmas & Happy New Year !!! - 1. Merry Christmas and Happy New Year !!! 2. We have come to a year end almost. Bid farewell of 2016 and welcoming the year of rooster 2017. It about ti...9 years ago

-

Any Potential For The KLCI To Break Out At 1,675 Points ? - Based from the chart reading, the KLCI now trending at a bit positive upside. It seems that the 1MDB issue didn't bring any effect to the markets. Malaysi...9 years ago

-

Warren Buffett's Wealth Building Milestone - http://www.gobankingrates.com/personal-finance/rich-warren-buffett-age/ I replot the data of Warren Buffett's wealth from the link that I found, to exa...9 years ago

-

-

HOW SIRUL BLACKMAILED NAJIB! - World Media Spotlight Now Moves To The Altantuya Case - Shocking new evidence has emerged over Malaysia’s most notorious murder case, with the airing of an explosive documentary about the death of Mongolian mod...10 years ago

-